USDCAD is one of the pairs expected to get more volatile today in the early afternoon. Labour market reports from both the United States and Canada will be released at 12:30 pm GMT today. While the US release is a bit less relevant than usual as FOMC has already announced the beginning of a QE taper, jobs data remains high on the traders’ priority list.

The US report is expected to show a 450k jobs gain, up from a 194k increase in September. However, ADP data released on Wednesday point to a 571k gain setting the bar even higher. On the other hand, it should be noted that the discrepancy between ADP and NFP reports was large last month (ADP 523k vs NFP 194k). Wage growth will also be watched closely as it is expected to accelerate to 4.9% YoY, the highest reading since February 2021. Accelerating inflation forces companies to boost wages and rising wages forces companies to increase prices, creating a vicious circle known as wage-price spiral.

Report from Canada is expected to show a 50k jobs increase, down from an increase of 157.1k in September. Unemployment rate is expected to drop from 6.9 to 6.8%.

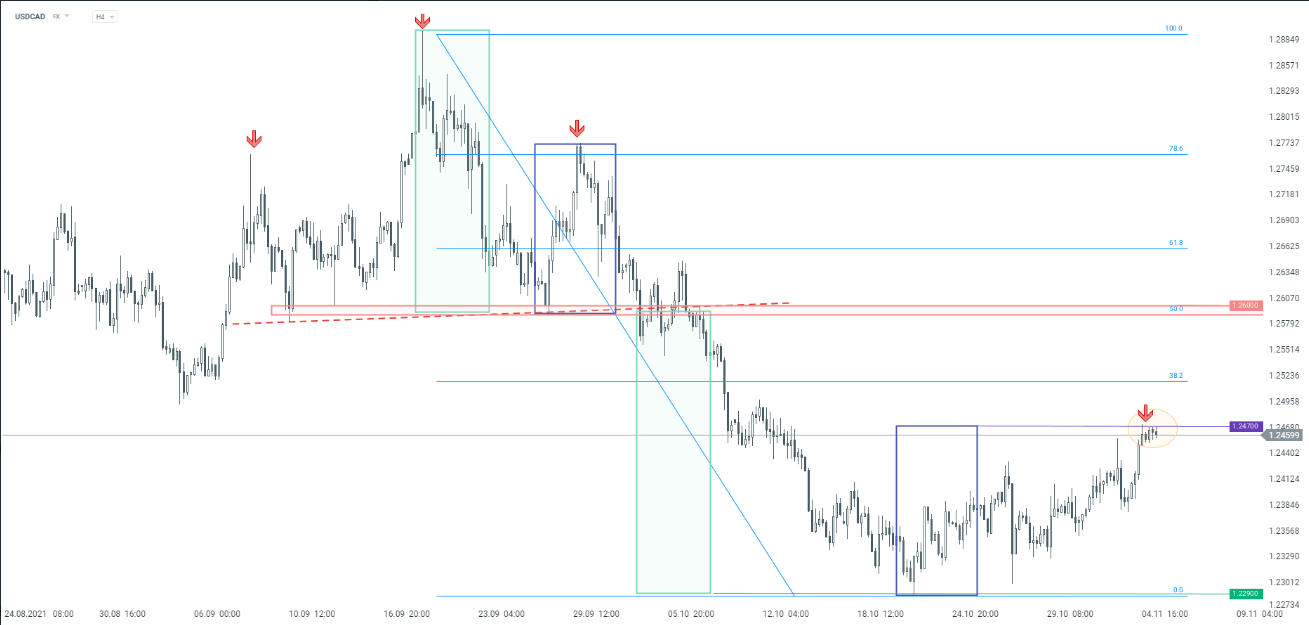

Taking a look at USDCAD chart at H4 interval, we can see that the pair has realized a textbook range of a breakout from a head and shoulder pattern (green boxes). The pair has launched an upward correction later on and is now testing a key resistance, marked with the upper limit of a local geometry (purple box). Reaction to this resistance may be a key to future moves. A break above could pave the way for an upward move towards 1.2600 while a break below could lead to a drop to 1.2290.